[I own DoorDash stocks. This is not investment advice. Do your own due diligence.]

This is a follow-up piece to my previous post on DoorDash (Sep 2021, link here).

I liquidated my previous DoorDash position in early- and mid- November 2021. Since then, I have been buying DoorDash again.

Summary

DoorDash is the No.1 Food Delivery company in the U.S. Controlling over 50% of the U.S. Food Delivery market, DoorDash has the largest delivery network, the highest work density, and the lowest delivery cost. It is a powerful network that can solve a variety of use cases, ranging from 10-min delivery to 1-day delivery.

Food Delivery is a great business. On a relative basis, among the three main delivery verticals — Food Delivery, Grocery Delivery, and Instant Delivery — Food Delivery has the largest and the fastest-growing TAM, the easiest operations, and probably the highest profitability. On an absolute basis, DoorDash’s Adjusted EBITDA–to–GOV ratio can reach ~6.5%. Assuming a 15% take rate, that is an Adjusted EBITDA margin of 43%!

At $35B of market cap (~$100 a share), DoorDash’s stock can comfortably offer investors a four-year IRR of 20%.

Risks

Shrinking GOV

DoorDash’s GOV declined between Q2 and Q3 2021. With 9 million DashPass members (Q3 2021), that is 7.0% of U.S. households, 5.6% of the U.S. workforce, and 2.7% of the U.S. population. Experience tells us that once a product penetrates 10% of its market, its growth usually slows down.

Another way to see it is this: If the COVID-19 Pandemic could not make some consumers use Food Delivery apps, how much marketing money would Food Delivery apps have to spend to acquire these consumers?

Other Risks

Drones and Self-Driving Cars: Innovative technology can drive delivery cost to nearly zero, eliminating DoorDash’s competitive advantage.

Labor regulations: California’s Prop 22 (2020) allowed platform companies to consider drivers “independent contractors,” yet it is still challenged in court.

Industry Basics

Consumers

Americans have been cooking at home less and less. Restaurants spend as a percentage of total food spend has increased from 25% (1995) to 51% (2020).

U.S. Food Delivery has a large TAM. Annual aggregate restaurant sales are ~$700B, of which Food Delivery sales are ~$300B (2019). In 2020 and 2021, ~20% of Food Delivery sales were realized on Food Delivery apps, with the rest taking place in traditional formats, such as call-in ordering.

Restaurants

Restaurants’ cost basis generally looks like this: Food (30%), Labor (30%), Rent (30%) and Profit (10%). Because Food and Labor are variable and Rent is fixed, incremental sales carry a true profit margin of 40% (=10%+30%). Therefore, seen from the lens of incremental sales, paying a 15%–30% commission to Food Delivery companies is not an unreasonable deal for restaurants.

Drivers

Drivers prefer Food Delivery. Versus ridesharing, doing Food Delivery is safer, cleaner, easier, closer to home and “quite chill.” Drivers do not even need a car to start delivering food on DoorDash. It is not a coincidence that when DoorDash announced “we added a record number of new Dashers” (2021 Q1 Letter), Uber and Lyft were suffering severe driver shortages.

Drivers can also earn more doing Food Delivery. Some 70%–80% of Food Delivery app users tip their drivers, and the average tipping rate is 17%–18%. It is not uncommon to see Food Delivery drivers making $25 per hour. For comparison, truck drivers make on average $20 per hour.

Competitive Dynamics

Three Main Players

DoorDash was founded in 2013 by Tony Xu, Stanley Tang, Andy Fang and Evan Moore. Tony’s original idea was to create a “FedEx for local businesses.” DoorDash started with restaurants because food delivery is the highest frequency category that can create a lot of network activities.

Leading up to its 2020 IPO, DoorDash had raised a total of $2.5B. Its IPO brought in another $3.3B (net of fees). As of 2021 Q3, DoorDash was sitting on $4.7B of cash and cash like assets.

DoorDash has entered new delivery verticals:

- April 1, 2020: Launched Convenience category, partnering with convenience stores

- August 5, 2020: Launched DashMart, a convenience store owned and operated by DoorDash

- August 20, 2020: Launched Grocery category, partnering with grocery stores

- December 6, 2021: Launched Ultra-Fast Grocery Delivery, beginning with DashMart in NYC

As of the end of 2021, ~10% of DoorDash users were using non-restaurant delivery services; DoorDash’s GOV composition was as follows: Food (~96.5%), Convenience (~2.5%), and Grocery (~1%).

Uber Eats was launched in 2014 and became an independent app in 2015. In 2017, Travis Kalanick left Uber and Dara Khosrowshahi took over the firm. Uber’s market share in U.S. Food Delivery has oscillated between 25% to 30% in recent years.

Grubhub was started as a marketplace demand-generation business in 2004 and it didn’t launch its own third-party delivery business until 2015. In its prime, from 2013 to 2018, Grubhub was highly profitable with an Adjusted EBITDA–to–GMV ratio of ~4.5%. Since then, Grubhub’s market share and profitability have quickly deteriorated. In mid-2021, Grubhub was acquired by Just Eat Takeaway.com. Four months later, Grubhub’s founder Matt Maloney left to “pursue other opportunities.” Today, Grubhub’s market share has shrunk to 15%.

In market share, around late 2018 and early 2019, DoorDash surpassed both Uber Eats and Grubhub. In mid-2020, DoorDash’s market share reached beyond 50%, larger than all other players combined.

In terms of capital efficiency, from 2018 to 2020, DoorDash burned through $444M of EBITDA for $35.5B of GMV (note: DoorDash is mostly U.S.); Uber Eats burned through $2,846M of EBITDA for $52.7B of GMV (note: Uber Eats is Global). See the table below. No wonder people say, for Food Delivery, profitability accrues to the leaders, but serious costs accrue to everyone else (Sarah Travel, 2020).

Management

Tony Xu immigrated to the U.S. from China when he was five years old. Because of his background, it is reasonable to speculate that Tony is familiar with Meituan. Given Meituan’s spectacular success — it being the world’s first profitable food delivery company, Tony’s ability to learn from Meituan is a true strategic advantage to DoorDash.

Tony is a well-respected industry leader. Many business operators and financial investors speak highly of Tony. Tony has thought thoroughly about his own job. In a recent interview, Tony described that his job as CEO has four parts: 1) to never run out of cash; 2) to hire the senior team; 3) to set the strategy; 4) to build and sustain a great culture especially as the organization evolves (Slush 2021).

Common phrases people use to describe DoorDash’s company culture include the following: “1% better every day,” “operating at the lowest level of details,” and “strong writing culture,” “extreme ownership.” Since 2015, Tony has been demanding all DoorDash employees to do one frontline job per month, such as delivering food themselves.

Ownership

Key individual owners are Tony Xu (~3%), Andy Fang (~3%), and Stanley Tang (~2%). Key institutional owners are Sequoia (~15%), SoftBank (~10%), and GIC (~7%). Through a multi-class share structure and voting agreements, Tony has the majority control over DoorDash.

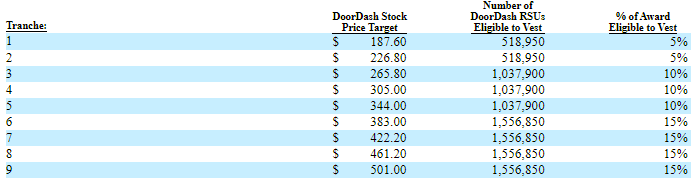

In November 2020, DoorDash’s board granted Tony “CEO Performance Award”: ~10.4M of additional Class A shares if DoorDash stock price can hit a series of target levels. See below.

New Product Verticals

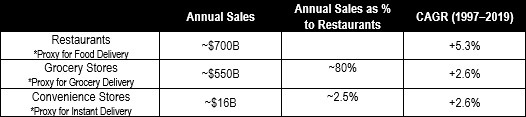

My sense is that Food Delivery will remain as the single largest delivery vertical for a long while. Of the three existing delivery verticals — Food Delivery, Grocery Delivery, and Instant Delivery — Food Delivery has by far the largest TAM and by far the fastest growth. See the table below. All numbers are U.S. figures.

As seen in the table above, Food Delivery’s TAM is larger than Grocery Delivery and Instant Delivery combined, and Food Delivery’s TAM is growing twice as fast as the other two.

In terms of actual on-the-ground operations, Food Delivery is probably the easiest among the three. Grocery Delivery faces at least the following operational challenges:

- It takes a lot of time to pick and pack. Neither grocery stores nor delivery drivers want to do it.

- Inventory problems in that delivery apps may not know whether a particular item is out of stock.

- Quality problems in that consumers may not like the specific items picked by other people.

Instant Delivery is probably the worst business type among the three. It has the smallest TAM, and it comes with the most daunting operational challenges, for example:

- It is asset heavy in that operators usually own and operate the stores themselves.

- To deliver under 10–15 minutes, delivery drivers are usually “full-time” or “near–full-time.”

- Because of the “hub-and-spoke” model, drivers waste time and mileage doing “round-trips.”

Grocery Delivery and Instant Delivery face serious profitability challenges as well. Grocery stores are known to be a low margin business (1%–3% net margin). Convenience stores’ profitability profile can be better, but nowhere close to restaurants’ 10%–40%. After all, Food Delivery works because it takes advantage of restaurants’ high “variable” margin. That high “variable” margin exists because for most restaurants, their kitchen capacities are frequently under-utilized — i.e., most restaurants can cook much more food with the existing staff members and kitchen facilities.

Even if Grocery Delivery and Convenience Delivery work, their combined TAM would be smaller than Food Delivery. And their combined profitability would be even smaller.

As a side note, I feel moderately bearish about Grocery Delivery companies and Instant Delivery companies — time will tell whether their business models work. A possible scenario is that today’s Grocery/Instant Delivery companies will see their financial losses expand faster than their GMV can expand — which, sadly, will serve as a mathematical proof that their models do not work.

Stock Valuation

TAM

I make three attempts to predict DoorDash’s TAM by 2025.

- Method A (bottom-up): ~13% of the U.S. population will be using DoorDash, placing 4.5 orders per month with an average order value (AOV) of ~$42, that is a 2025 GOV of ~$100B for DoorDash.

- Method B (bottom-up): ~16% of the U.S. households will be using DoorDash, placing 4.5 orders per month with an AOV of ~$64, that is a 2025 GOV of ~$75B.

- Method C (top-down): U.S. restaurant sales will grow at its historical average rate of 5.3% p.a. and total sales going through Food Delivery apps will rise from ~8% (2020) to ~15% (2025). DoorDash market share will grow to 65% by 2025. That gives a 2025 GOV of ~$80B.

So, by 2025, DoorDash’s GOV could well reach $75B–$100B (note: this is U.S. Food Delivery only).

Profitability

DoorDash’s IPO Prospectus shows that for cohorts older than two years, DoorDash can make an 8% Contribution Profit–to–GOV margin. Given R&D and G&A together cost ~1.5% of GOV (and may trend down further as DoorDash grows), that means in the long run, DoorDash can achieve an Adjusted EBITDA–to–GOV margin of ~6.5%. Assuming a take rate of 15%, that is a profit margin of 43%!

Target Price

Valuing growth stocks is difficult but let me still give it a try.

First, try to understand the current stock price. DoorDash’s current GOV is ~$41B (2021). Without growth, by 2023 (as cohorts mature), DoorDash’s Adjusted EBITDA would be ~$2.7B (=$41Bx6.5%). Given DoorDash’s current market cap of ~$35B, that is a P/E multiple of only 13x.

Then, to make some predictions of future stock prices. I list out Bear/Base/Bull cases below, assuming a current market cap of $35B.

The base case is a 20% IRR for the next four years for today’s $35B DoorDash.

Across all these predictions, I have not factored in 1) DoorDash’s Grocery Delivery and Instant Delivery businesses, nor 2) DoorDash’s international expansion to Europe, Japan, and Australia. These new verticals and regions, I suspect, would turn out to be smaller in TAM and lower in profitability, as I elaborated above. Nevertheless, any successes in these new spaces would add extra juice to the stock’s future returns.

That is why I am still bullish on DoorDash.

(END)

[…] post on February 3, […]

LikeLike

[…] position. In early November 2021, I completely liquidated my DoorDash holdings (see my earlier post). Since then, I have been accumulating DoorDash stocks, buying aggressively in very recent weeks. […]

LikeLike

[…] wrote on Sep 4, 2021 (link) and again on Feb 3, 2022 (link) that DoorDash can be highly profitable. My predictions have been confirmed by DoorDash’s […]

LikeLike