[I own DoorDash stocks. This is not investment advice. Do your own due diligence.]

Studying DoorDash’s 2022 Q1 earnings, released on May 5, 2022, I am convinced that DoorDash is in great shape.

Many of DoorDash’s metrics are hitting all-time high. Tony Xu, CEO of DoorDash, said on CNBC the day after company earnings: “what we see internally and in the fundamentals is all-time highs in our user base, all-time highs in our DashPass subscriber program, as well as order frequency across all cohorts, as well as increasing profitability in an already profitable business which is our U.S. restaurant business.”

DoorDash’s Core Business is Highly Profitable

I wrote on Sep 4, 2021 (link) and again on Feb 3, 2022 (link) that DoorDash can be highly profitable. My predictions have been confirmed by DoorDash’s leadership team:

- Feb 16, 2022: Tony said in that earnings call (2021 Q4) that “we have such a robust core business that’s producing positive cash flow.”

- May 5, 2022: Prabir Adarkar, CFO of DoorDash, said in the earnings call (2022 Q1) that “the core U.S. restaurant business is profitable. It’s growing and the profit margins continue increasing.”

DoorDash’s market share is also growing… so, stop and think… DoorDash is growing its profit margin and its market share together.

Read it once again. How powerful it is! “Flywheel”! “Network Effect”!

DoorDash does not disclose the exact profitability of its core U.S. restaurant business. However, triangulating publicly available data, I was able to back out how profitable DoorDash’s business is.

Two important data points:

- On DoorDash’s IPO Prospectus (Dec 8, 2020), page 116, a chart showed that for DoorDash’s mature cohorts, Contribution Profit as a % of GOV reached 5% to 8%. See below.

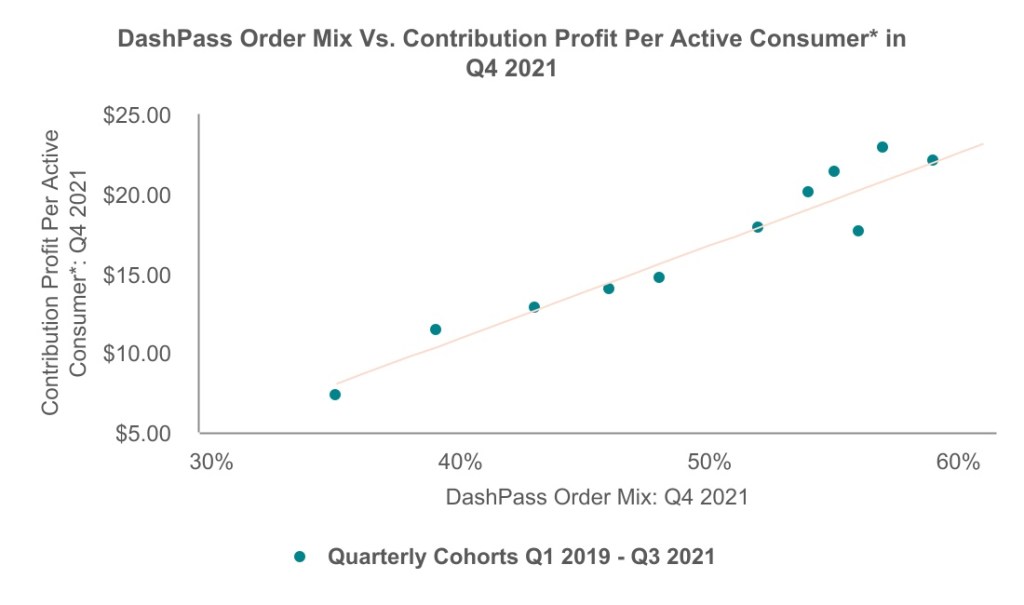

- On DoorDash’s 2021 Q4 Investor Letter (Feb 16, 2022), page 3, a chart displayed Contribution Profit per active consumer in Q4 2021. That chart is a bit confusing, so in the earnings call, Prabir clarified that “the right side of the chart are the older cohorts” — that is, on the far-right side are two-year-old, three-year-old cohorts, and their quarterly Contribution Profits have reached ~$24 per active user.

Let’s plug in some supporting data points:

- In 2021, DoorDash ended the year with over 25M MAU and 1,390M total orders. That is ~4.6 orders per user per month.

- I estimate that the average order value (AOV) is ~$34. This is in line with 3rd party estimates and in line with the $32.90 figure appeared on DoorDash’s IPO Prospectus (page 103, Dec 8, 2020).

Now, let’s do some simple math:

- The average DoorDash consumer spend per quarter would be this: $34 AOV x 4.6 orders per month x 3 months per quarter = ~$470.

- To cross check that $470 number, Second Measure (a 3rd party data vendor) published on April 14, 2022 that DoorDash’s “Average Quarterly Sales per Customer” is ~$325.

- Hence, for DoorDash’s mature cohorts, Contribution Profit margin (as a % of GOV) is $24 / $470 = 5.1%.

- To cross check that 5.1% number, Second Measure’s $325 quarterly sales would yield a Contribution Profit margin of $24 / $325 = 7.4%.

Bingo! Whether you take 5.1% or 7.4%, they match closely with the chart that appeared originally in DoorDash’s Prospectus, which showed a GOV profit margin of 5% to 8%.

The significance of doing this exercise is to show 1) DoorDash’s core business is highly profitable, and 2) DoorDash’s profitability has not meaningfully deteriorated during the past two years — both of which lend support to DoorDash’s equity valuation.

Let’s look at additional cost items between Contribution Profit and Net Profit. Remember, DoorDash’s Contribution Profit is already net of DoorDash’s “Sales and Marketing” spend. So, the remaining cost items are as follows (all using historical data):

- Research and Development: ~0.6% of GOV

- General and Administrative: ~1.3% of GOV

- Stock-based Compensation (SBC) and payroll tax expense: ~1.2% of GOV.

So, additional expense items come in total to be about ~3.1% of GOV.

All in all, we arrive at a net profit margin (as a % of GOV) of 2.0% (=5.1%-3.1%) to 4.3% (=7.4%-3.1%).

DoorDash’s current take-rate is ~12% (take-rate = revenue / GOV). That means DoorDash’s net profit margin (as a % of revenue) on its mature cohorts is somewhere between ~15% (=2.0%/12%) and ~35% (=4.3%/12%).

Therefore, I say, DoorDash is a highly profitable business.

DoorDash’s Valuation is Cheap

Once we establish that DoorDash’s net profit margin can reach 2.0% to 4.3% of GOV as its cohorts mature throughout time, it becomes obvious that DoorDash is a cheap stock.

A thought experiment: Assume DoorDash stops growing its GOV now. Let DoorDash’s cohorts mature throughout time. DoorDash’s current GOV run rate of ~$50B a year would then translate into a net profit of $1B (=$50B x 2.0%) to $2.1B (=$50B x 4.3%).

DoorDash’s market cap is ~$23B. It has $4.2B of cash and cash-like assets and it has no debt. So, the equity value of DoorDash’s business is ~$19B.

That means, DoorDash’s stock is trading at a P/E multiple of 9x (=$19B/$2.1B) to 19x (=$19B/$1B).

NASDAQ’s P/E multiple stands at ~28x; S&P 500’s stands at ~22x. DoorDash is growing its business at 15% to 25% YoY and is already profitable and is becoming more profitable with time. Clearly, DoorDash is a cheap stock.

A Few Other Thoughts

Driver supply, Food Delivery vs Ridesharing: Driving food packages around in your own neighborhoods is a much more attractive job than driving strangers to unknown places — and I wrote extensively before on this point (link). Lyft and Uber will have to keep incentivizing people to drive strangers. While Lyft and Uber are burning cash to attract drivers, DoorDash reported for 2022 Q1 that “our cost to acquire new Dasher is the lowest it’s been in the last four quarters.” Dasher supply is so abundant that Prabir told analysts that “our batch rates are down both QoQ and YoY” (because batch rates usually go up when there are not enough drivers). Tony told CNBC on May 6, 2022, “well, we actually don’t see any connection between delivering goods and delivering people.” Because of the nature of the job, driver supply is an advantage to DoorDash but a disadvantage to ridesharing companies like Uber and Lyft — and the difference eventually shows up on Income Statements.

Profit dollar distribution among Food Delivery players: For Food Delivery, I believe that No.1 player makes the most profit. The No.2 player barely makes any money. The No.3 player hemorrhages cash. It is about the relative market share advantage enjoyed by No.1 against No.2’s and No.3’s market shares. It is about being the No.1 in the world’s largest markets. It is never about being the No.2 across many different markets. That is the difference. DoorDash is fortunate to control the U.S. Food Delivery market, which is a superior Food Delivery market. We are seeing it pay off.

On inflation: Prabir said “this [inflationary pressures and resulting AOV increases] would also have a positive impact on our margins.” This echoes my one-year-old prediction, which I wrote on Feb 12, 2021 about inflation’s impact on delivery business and I wrote then: “their businesses are somewhat ‘indexed’ to inflation” (link). DoorDash is an asset-light business. It draws its revenue from “take-rate.” Inflation just passes through DoorDash’s system without damaging the system. After all, Tony Xu, a first-principles thinker, has said this many times: “people eat three times a day and 90 times a month.” People are not going to stop eating because of inflation. People are not going to like home-cooking more because of inflation. A love for food. A love for convenience. Those are deep human desires that have nothing to do with inflation. These desires drive demand for Food Delivery and for DoorDash.

On Convenience and Grocery deliveries: Tony said at this latest earnings call: “the penetration levels today in convenience and grocery delivery is fairly low and has largely stagnated post-COVID. And I think that suggests that the customer actually prefers perhaps either buying online, picking up in store or perhaps just shopping inside the store altogether.” Yes, he used the word “stagnate.” This echoes my blog piece on Feb 11, 2022 (link) where I questioned the prospects of convenience and grocery delivery. Not a good sign for delivery companies that focus on non-restaurant verticals.

(END)

[…] I wrote in my prior blog piece (see here), I continue to believe that DoorDash benefits from inflation in many […]

LikeLiked by 1 person