Disclaimer: given the uniquely notorious reputation surrounding the book and the author, I want to make it clear that, in this article, I am not commenting on the morality of the book nor the author — I have zero intention in writing or implying anything in that regard.

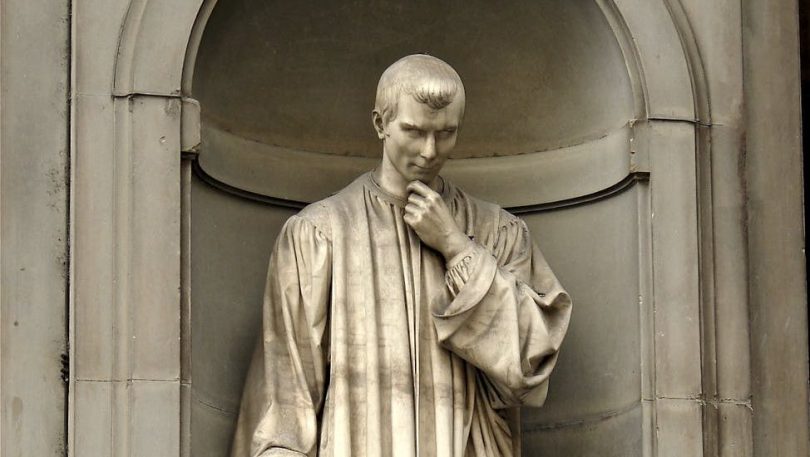

Recently, I got a chance to read The Prince — the remarkable yet controversial book by Niccolò Machiavelli. Many people hold extremely negative views about the book and its author. Others see the book as one of the most influential works for modern political philosophy. I didn’t expect much prior to reading it.

Post the read, to my surprise, I realized the author Machiavelli might possess some of the qualities that are needed for successful investing.

“The end justifies the means”

Some investors like to self-identify as “the true practitioner of orthodox value investing principles,” “differentiated portfolio manager with a clearly defined investment process,” etc. Some investors like to spend a majority of their time sharpening the sales pitch of their fund products. These investors become so fixated on the means that sadly they forget the end that they were originally tasked to pursue. Everyone has a nice pitch book, and everyone has a sharply defined investment strategy — “the means.” Sadly, few can consistently deliver strong IRR — “the end.”

I argue that there is a right investment philosophy for a time, but not for all times. The capital market is constantly changing; blindly holding onto some obsolete or unrealistic investment beliefs will lead investors to nowhere. A realistic approach is to first understand that the end is to generate a high and consistent IRR. With that end goal in mind and with all the right values of being ethical and compliant, investors then seek to understand the market with a framework that is both analytical and tight, aiming to “back out” the means — i.e., an investment strategy that fits the contemporary capital market environment the best and an investment tactic that most effectively enables the investors to participate in the market.

To quote Machiavelli:

… the prince who relies entirely on Fortune will fall when Fortune changes. In my view, he who conforms his course of action to the quality of the times will fare well, and conversely he whose course of action clashes with the times will fare badly.

Think independently, it is not easy

“Think independently!” It is easy to say but hard to do. Humans are social animals. Our instinct is to form groups, to conform with groups — after all, that is usually a sure way to survive. Those who deviate from their groups to become independent risk facing grave danger — unless they have great skills (and some good luck as well). Staying with a larger group, you survive, and you get mediocrity. Acting independently, you lose big, or you win big. That is the tradeoff. This is another reason why successful investors are rare.

Machiavelli knew it well some 500 years ago that most people cannot act independently, and most people just imitate others and end up in mediocrity.

To quote Machiavelli:

Men will always follow paths beaten by others, and proceed in their actions by imitation. But as they are rarely able to keep to these paths, or to match the skill of those they imitate, a prudent man should always set out on paths beaten by those who are truly great and worthy of imitation. This way, even if his own skill does not attain the same heights, he can at least expect to achieve some of the effect.

Alignment of Interests

Even though he didn’t say it that way, Machiavelli clearly understands the importance of “alignment of interests.” Machiavelli despised the idea of using a mercenary army or an auxiliary army. Of the mercenary army, Machiavelli said, “all that keeps mercenaries on the battlefield are the negligible wages you pay them, which are not sufficient to make them want to die for you.” Of the auxiliary army, Machiavelli said, “if this army loses, he [the prince] ends up dissatisfied, and if it wins, he ends up its prisoner.”

Those thoughts can be applied to today’s investment world. Serious investors should never outsource their investment decisions to a mercenary army or an auxiliary army. Serious investors should own his/her own army — i.e., do your own homework, do it well; make your own decisions, independent of other people’s opinions. If you can make money on your own, why do you still feel the urge to raise external money (if not for the fees)? If the person pitching you across the table is a true money maker, why is he/she still spending time pitching you? If someone already knows the winning lottery numbers, why is he/she still motivated to sell you lottery tickets?

Understand what is on the ground

Machiavelli understands the importance of understanding what is on the ground. Successful investing also requires investment managers to roll up their sleeves, get their hands dirty, and experience on-the-ground realities. But how many of the well-paid investment managers who own DoorDash stocks have tried to deliver food as a Dasher? How many investment managers who bet big on Uber stocks have driven as an Uber driver? The simple truth is that it is not easy to get your hands dirty. It is a lifestyle problem. It is an attitude problem. “I cannot go that low.” People rather sit comfortably in an expensively decorated office, thinking they know what is going on without actually knowing what is going on.

To quote Machiavelli again:

[The prince] must not only keep his troops well trained and organized, but must also himself continuously go out hunting, keeping his body accustomed to hardship, while learning the lay of the land: how the mountains rise and the valleys dip, how the plains lie, and the nature of the rivers and marshes.

(END)